M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

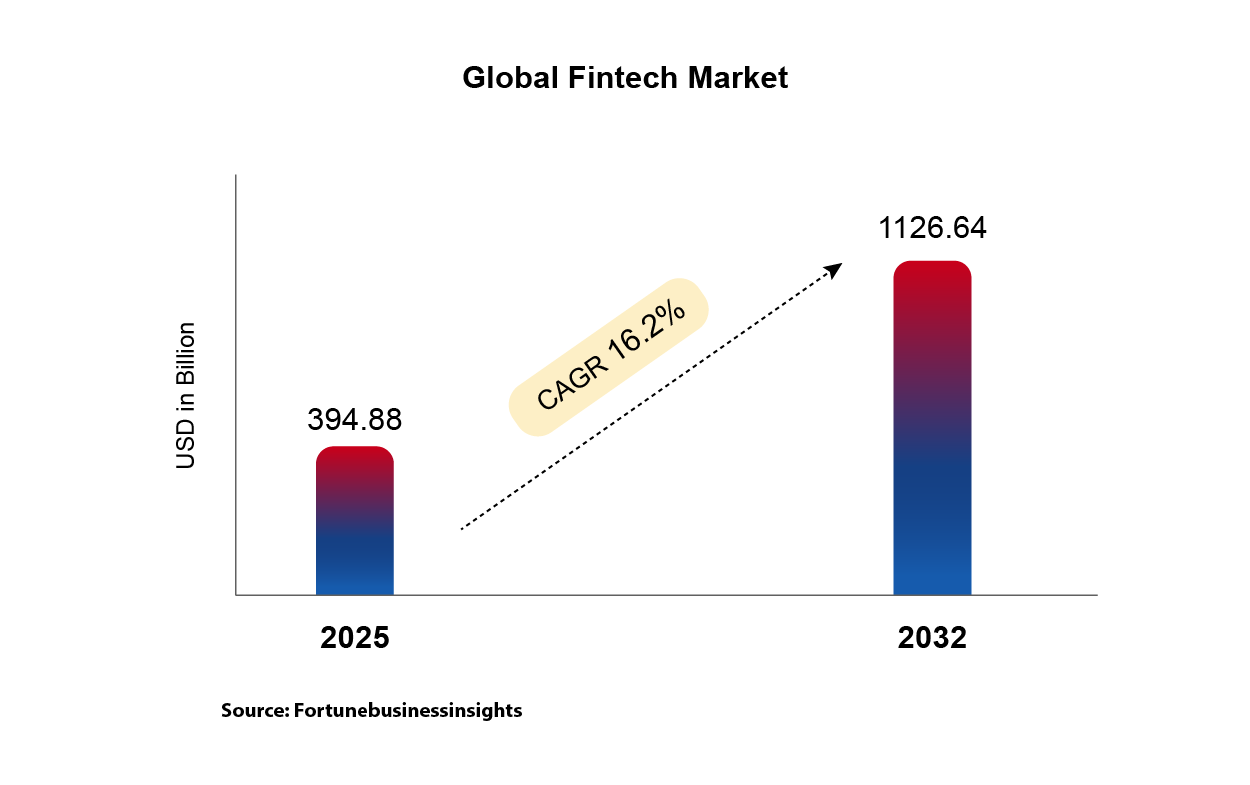

As of 2025, the global fintech market has surged to $394.88 billion, with projections soaring to $1.13 trillion by 2032. This explosive growth is fuelled by AI-led innovation, embedded finance, and a wave of digital adoption that’s transforming how billions manage, move, and multiply their money. With over 30,000 fintech startups worldwide and 64% of global consumers now using fintech services, the industry isn’t just evolving—it’s redefining itself.

At the heart of this transformation lie the 5Ds of Fintech, each reshaping the future of financial services from the ground up:

Fintech is becoming frictionless. With 92% of global consumers engaging in online banking and transactions, the industry has embraced cloud-native architecture, embedded finance, and app-centric experiences. These innovations eliminate traditional pain points, making banking as seamless and intuitive as users expect—delivering speed, personalization, and convenience at every touchpoint.

Data is the new digital currency. AI and machine learning now process real-time behavioral and transactional data to deliver hyper-personalized financial experiences. Today, over 60% of lending decisions are powered by AI analytics, enabling institutions to offer tailored products across credit, insurance, and wealth management.

Fintech is breaking down barriers to financial access. By 2025, digital financial services could inject $3.7 trillion into emerging market GDPs and create 95 million new jobs. Innovations like micro-investing platforms, mobile wallets, and simplified onboarding are turning financial inclusion from aspiration into reality.

Fintech disruptors are rewriting the rules. In India, digital lending platforms now command 25% of the personal loan market, challenging traditional banks. Globally, BNPL services are booming, with market size nearing $40 billion. Neobanks and tokenized assets are redefining customer expectations, forcing legacy institutions to innovate or risk irrelevance.

Blockchain and smart contracts are powering a new era of decentralized finance (DeFi). These platforms eliminate intermediaries, offering transparent, user-controlled financial services. Innovations like tokenization of real-world assets, cross-chain interoperability, and AI-powered fraud detection are making DeFi smarter, safer, and more accessible.

Across every D, artificial intelligence acts as the force multiplier, accelerating innovation, enhancing efficiency, and enabling fintechs to anticipate and meet evolving customer needs at scale.

The 5Ds and the accelerating influence of AI aren’t just shaping fintech but they’re building the blueprint for the future of global finance.

Fintech market is set to triple in value!